New Arrivals

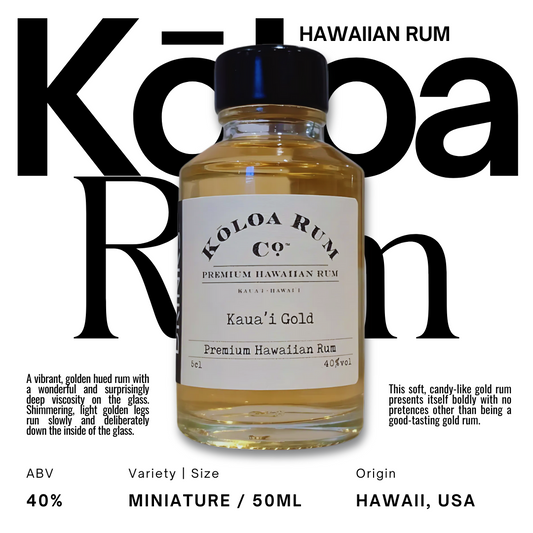

- Regular price

- £38.95

- Regular price

-

- Sale price

- £38.95

- Unit price

- / per

- Regular price

- £33.95

- Regular price

-

£0.00 - Sale price

- £33.95

- Unit price

- / per

- Regular price

- £50.95

- Regular price

-

- Sale price

- £50.95

- Unit price

- / per

Best Sellers

- Regular price

- £38.95

- Regular price

-

- Sale price

- £38.95

- Unit price

- / per

- Regular price

- £34.95

- Regular price

-

- Sale price

- £34.95

- Unit price

- / per

- Regular price

- £46.95

- Regular price

-

- Sale price

- £46.95

- Unit price

- / per

DUE DILLIGENCE POLICY

TRADE CUSTOMER DUE DILIGENCE POLICY

As a part of the Alcohol Wholesaler Registration Scheme (AWRS), United Drinks Limited are required to conduct due diligence checks on both trade customers and suppliers involved in the supply chain for alcoholic drinks.

Due diligence is important for our business to minimise exposure to commercial risk, reduce the risk of being exposed to fraudulent transaction chains and reduce the risk of being exposed to significant financial losses.

Making due diligence an obligation for all businesses involved in alcohol will help drive fraudsters from the market place, increase consumer confidence in the sector, boost legitimate businesses by restoring a level playing field and help maintain confidence and reputation.

We carry out extensive due diligence checks following the guidelines from HMRC and the 'FITTED' checks as a structure to establish potential risk within supply chains. We ensure we 'know our customer and supplier.

Any customers or suppliers identified as high risk will undergo further questioning before we decide if we will begin to trade. Due diligence will be evaluated every 6 months for high risk customers/suppliers, annually for all others, with regular reviews to highlight any changes in activity so the appropriate actions can be taken.

All customers and suppliers must provide the required list of documents and completed questions for United Drinks Limited to undertake risk assessment before any account is opened. United Drinks Limited will only trade with a customer or supplier that has passed the assessment checks.

Any customers or suppliers who don't pass our internal checks will be notified that we are unable to open an account and unable to trade. Any business with suspicious behaviour will be reported to HMRC in a timely manner.

Information submitted will be reviewed on a case-by-case basis and the company director will conduct final sign off.

All initial checks and further reviews will be documented in the customer or supplier file electronically. Reminders for checks should be logged into CRM software and Google calendar reminders.

Day-to-day checks will be carried out to identify any potential transactions that may lead to fraud or involve goods on which duty may have been evaded. These checks are made on both supplier purchase ordering and customer sales orders.

Purchase ordering

All orders are raised through official purchase orders for approved suppliers. The orders are emailed across to the supplier directly with the full details of the product and price. If any delivery hasn’t been received within the required window, we will raise a query with the supplier or haulier.

Customer ordering

For any new sales, we will first check that the customer’s due diligence file is up to date by checking Active Campaign and reviewing the due date. Customer orders are received in writing by email. Orders are then assessed alongside the due diligence provided on a case-by-case basis.

For a business customer to open an account:

In order for a business to register for trade in alcohol, United Drinks Limited will require the following documents:

• Copy of Incorporation Certificate

• Copy of VAT Certificate

• Company Bank Details

• Owner Photo ID Details such as Passport & Driving License

• Copy of Business Utility Bill (Less than 3 months old)

• Copy of Lease agreement or proof of Freehold of the business premises

Once United Drinks Limited has collated this information, the necessary cTrnsfershecks will be conducted before opening the account. Payment methods are Bank Transfer, Cheque or Credit Card only. United Drinks Limited does not accept cash payments. Bank Transfer payments can only be accepted under the Money Laundering Regulations. Note that photo ID may be requested for card payment at the time of payment. There is also a charge of 3% on any credit card payments. Third party card and cheque payments will not be accepted. Any customers identified as high risk will undergo further questioning. High risk customers that are accepted will be evaluated every three months; all other customers will be reviewed on an annual basis.

For a wholesaler to open an account:

In order for a business to register as a wholesaler, United Drinks Limited will require the following documents:

• Copy of Incorporation Certificate

• Copy of VAT Certificate

• Company Bank Details

• Owner Photo ID Details such as Passport & Driving License

• Copy of Business Utility Bill (Less than 3 months old)

• Copy of Lease agreement or proof of Freehold of the business premises

• Signed account forms

• Picture of business address, if applicable

Once the information has been gathered, we will complete a risk assessment. Any customers identified as high risk will undergo further questioning. High risk customers that are accepted will be evaluated every three months; all other customers will be reviewed on an annual basis. Any suspicious retail pricing at uneconomic levels or improper trading patterns will be reported to HMRC in a timely manner.

SUPPLIER DUE DILIGENCE POLICY

As a part of the Alcohol Wholesaler Registration Scheme (AWRS), United Drinks Limited is required to conduct due diligence checks on partners involved in the supply chain for alcoholic drinks. United Drinks Limited will require the following documents for a wholesaler to open an account to start trading:

• United Drinks Limited due diligence questionnaire

• Copy of Incorporation Certificate

• Copy of VAT Certificate

• Copy of company’s last filed set of accounts

• Copy of Money Laundering Certificate, if applicable

• Owner/Director’s/ Proprietor’s photo ID

• Company Bank Details

• AWRS number

• Copy of Business Utility Bill (Less than 3 months old)

• Headed paper complete with Director’s Signature

• Proof of Due Diligence the company carries out

• Copy of company’s term

• If you are a UK duty paid supplier, please provide us with copies of form W-5 (or similar document) showing evidence of duty payment

Once the supplier has sent the above information, we will review it. The overall risk of the supplier will be established. If the business is identified as a high-risk supplier, further questions will be asked, and site visits will be conducted as appropriate. Any suspicious retail pricing at uneconomic levels or improper trading patterns will be reported to HMRC in a timely manner. All high-risk suppliers will be reviewed every three months; all other suppliers will be reviewed on an annual basis.

We will check if an alcohol wholesaler is approved by verifying their AWRS license number on the government portal:

https://www.gov.uk/check-alcohol-wholesaler-registration